英国退欧后的金融稳定:全球债务风险

文章

2019/05/14

在过去10年的债务演变过程中,我要指出的另一个引人注目的发展是新兴市场,主要是中国,而不是发达经济体的债务。新兴市场债务目前占全球债务总额的四分之一以上,而危机前这一比例仅为八分之一。

在此背景下,中国的私人债务持续累积,达到创纪录水平:不包括金融业在内,私人债务占GDP的比重已从2008年的115%升至203%。

其中大部分增长发生在金融危机后的几年里,但中国私人债务在过去5年里持续增长,占GDP的30%,其中很大一部分是通过监管较少的影子银行业进行中介的。增幅最大的是企业部门,主要是国有企业,但最近家庭债务开始迅速增长。

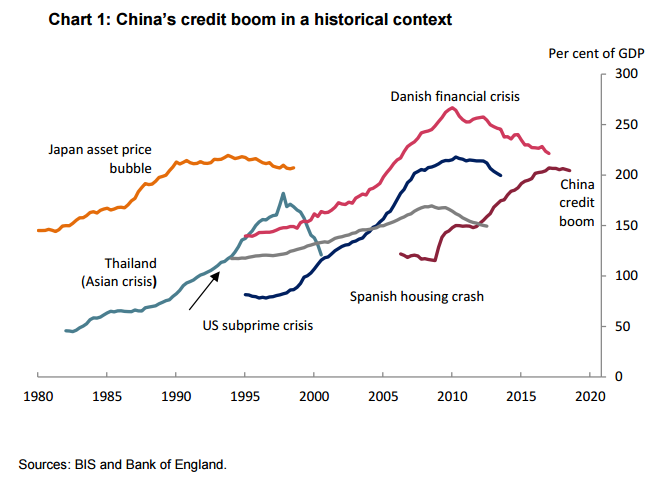

正如国际清算银行过去公布的那样,增长速度和水平已经超过了其他经济体(发达经济体和新兴经济体)过去经历大幅调整的水平(图1)。

自2017年初以来,中国政府采取了重大政策措施,降低金融业风险,使债务增速与名义GDP增速保持一致。

然而,最近,面对经济增长放缓,它们采取了一系列措施来支持国内信贷。经济增长大幅放缓将大大降低中国高企的债务水平的可持续性。

中国的外债规模较小,以人民币计价。虽然一些国际银行在其管辖范围内很活跃,但其金融体系并没有高度融入全球体系。中国的债务调整将首先且最直接地影响中国经济。

然而,预计这些影响将通过若干渠道溢出至更广泛的金融稳定。

中国经济对地区增长至关重要,是世界经济增长和贸易的主要支柱之一。除了经济影响和直接通过银行敞口产生的影响外,很可能还会对金融市场情绪产生严重影响,这种影响在2015年就显现出来了,当时中国国内金融市场经历了一段时间的大幅回调,引发了美国金融资产的回调。

请付费会员登录后阅读完整内容

登录后添加评论...